2020 or Later W-4 Form Federal Withholding Set Up

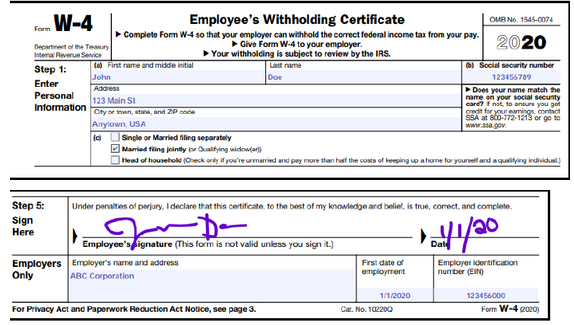

The IRS 2020 W-4 Employee Form provides the Federal Withholding information required for new hires and any current employee with W-4 filing status changes made after January 1, 2020. This information includes the employee's filing status, working multiple jobs calculation (including their working spouse), child tax credit, and other income that determines the standard deduction and tax rates used to compute withholding amounts.

2020 W-4 Federal Withholding Information

According to the instructions for completing the 2020 W-4 provided by the IRS, employees are required to complete their personal information in step1 as well as completing the signature section in step 5.

Steps 2 – 4 are completed only if they apply to the employee. Employees using these steps will follow the form instructions to include additional information for their withholding calculation.

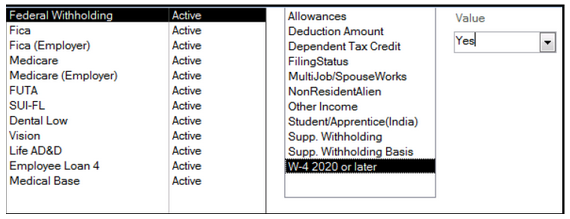

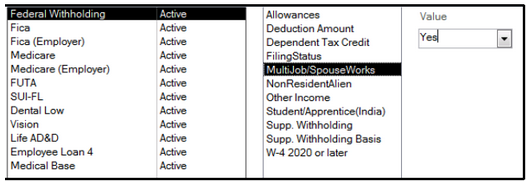

CertiPay’s Federal Withholding Deduction Attribute Fields:

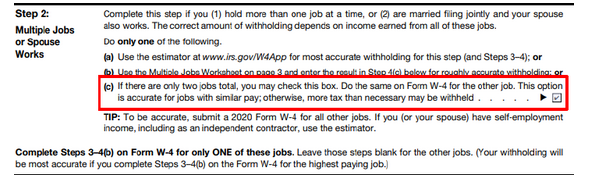

W-4 FORM STEP 2 (c) Checkbox = CertiPay’s Federal Withholding Field: Multi Job / Spouse Works

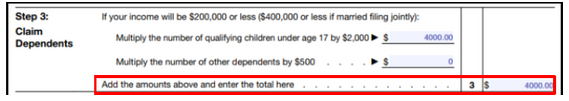

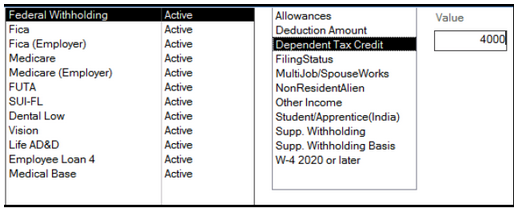

W-4 FORM STEP 3 = CertiPay’s Federal Withholding Field: Dependent Tax Credit

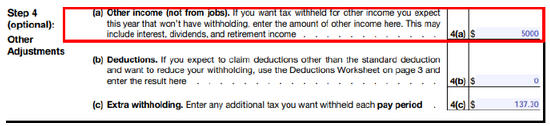

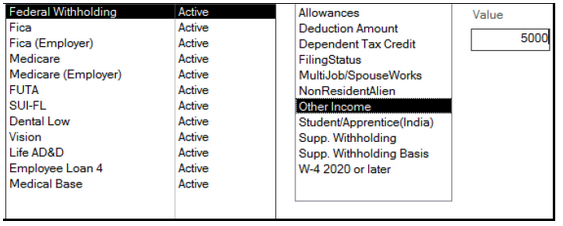

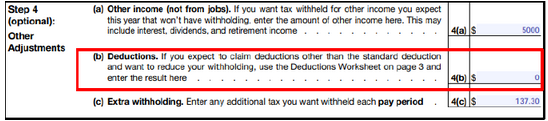

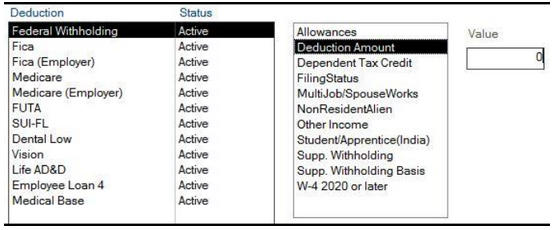

W-4 FORM STEP 4 (a) = CertiPay’s Federal Withholding Field: Other Income

W-4 FORM STEP 4 (b) = CertiPay’s Federal Withholding Field: Deduction Amount

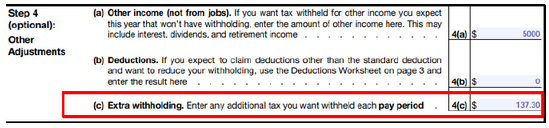

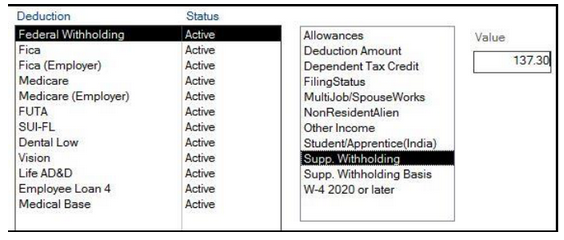

W-4 FORM STEP 4 (c) = CertiPay’s Federal Withholding Field: Supp. Withholding

The IRS allows current employees to continue to use withholding data from previous W-4 Forms on file. For all new hires or W-4 employee changes made after 1/1/2020 the Federal Deduction attribute field for “W-4 2020 or later” field must have “Yes” selected in order to compute the correct withholdings.